The first is the American Institute of Professional Bookkeepers (AIPB), and the second is the National Association of Certified Public Bookkeepers (NACPB). Both offer similar benefits regarding membership, resources and renewable credentials. While other bookkeeping credentials do exist, those offered by AIPB and NACPB are the most renowned and respected. A bookkeeper certification tells employers that you have all the skills and expertise required for advanced bookkeeping. Katherine Haan, MBA is a former financial advisor-turned-writer and business coach. For over a decade, she’s helped small business owners make money online.

You’ll get to review and reconcile accounts, record business transactions, and balance books to produce key financial statements for a variety of business types. Candidates must meet similar eligibility requirements for the CPB license and the CB credential. If you’re wondering whether to earn CB certification or CPB licensure, keep in mind that a professional designation can help boost your earning potential. According to Payscale, certified bookkeepers make around $57,000 each year.

National Association of Certified Public Bookkeepers

Even so, the BLS projects an average of 183,900 openings for bookkeeping, accounting and auditing clerks. The demand for new bookkeepers stems from a need to replace those who retire and workers who transfer to other industries. Bookkeeping includes everything from basic data entry to tax prep. A client’s financial activities will include all transactions related to their income and expenses and a bookkeeper is responsible for recording all of these transactions accurately. Some bookkeepers may also have to facilitate financial transactions and ensure transactions are legally compliant. You will need access to spreadsheet software (Excel, Google Sheets, Numbers or the equivalent) for some activities in this course.

- Each area is handled by one or more bookkeeping clerks, also called accounting clerks, who are supervised by a head bookkeeper.

- The first is the American Institute of Professional Bookkeepers (AIPB), and the second is the National Association of Certified Public Bookkeepers (NACPB).

- Free, self-paced, and designed for part-time completion in six weeks, edX’s course covers topics including banking processes, payroll, ledger accounts, and reconciliations.

- A bookkeeping certificate can help you find a bookkeeping role, either as an in-house bookkeeper or as a freelancer.

- The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence.

- A certificate may not be worth it if you already have a bachelor’s degree in accounting or a related field, or if you already have professional bookkeeping experience.

Some employers prefer to hire junior college or business school graduates for the position of full-charge bookkeeper. Good performance in business subjects such as business software, typing, accounting, bookkeeping, and business mathematics is an asset. The ability to use a computer is essential, and knowledge of basic spreadsheet and database programs is helpful.

Best for Small Businesses

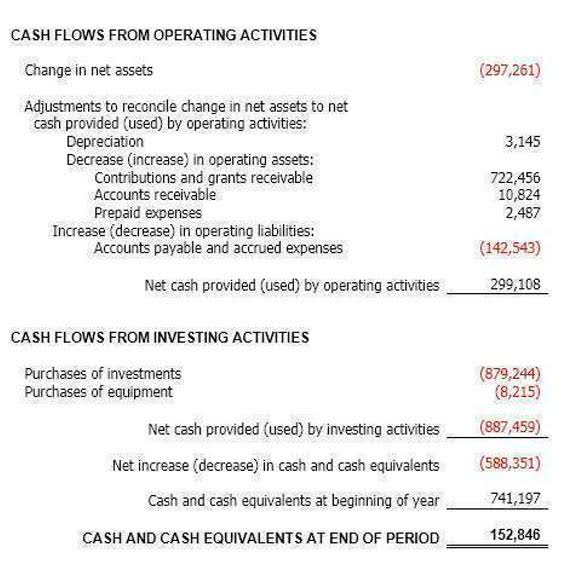

Each plan comes with a finance expert, automated transaction imports, P&L, balance sheet and cash flow statements. You’ll also get burn rate calculations, which is helpful for startups that need to closely track their spending. When you have a Small Business Plus plan or higher, you get unlimited online support. All plans come with onboarding, a dedicated bookkeeper professional bookkeepers and account manager, reconciliation at month-end, balance sheet, P&L, statement of cash flows and a portal with document storage. Higher-tiered plans unlock more transactions and a more frequent service level. If you’re just getting your business off the ground and project rapid growth, Pilot is worth exploring for your bookkeeping and business success needs.

Note that NACPB’s bookkeeping certification is different from its CPB license. Prior to earning either designation, you must prove that you have sufficient bookkeeping experience. Compare features, pricing, and expert reviews for your business software needs – all in one place. Our partners cannot pay us to guarantee favorable reviews of their products or services.

NACPB Supports, Trains, Certifies, and Licenses Bookkeepers

Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. For additional features, these were elements that fell into the “nice-to-have” category that not all software providers offered, either as part of their regular plan or as a paid add-on. Both kinds of features combined to account for 60% of our total score. For pricing, we considered whether a service offers a free trial or a free version of its software as well as the affordability of its lowest and highest price tiers. FinancePal is best for small businesses that need bookkeeping assistance, including catch-up bookkeeping, entity formation and tax filing. The BLS projects employment for bookkeeping, accounting and auditing clerks to decline by 6% by 2032.

- Access Xero features for 30 days, then decide which plan best suits your business.

- If you become a QuickBooks Live bookkeeper, you can work from home based upon an agreed schedule at a set hourly rate based on your location, interview, and experience level.

- Professionals looking to brush up on bookkeeping fundamentals can enroll in this introductory course from edX.

- Quizzes included throughout the workbooks help ensure information mastery.

- If you already have an accountant, talk to them about who they currently work with.

- While most bookkeepers work with businesses, some individuals may also choose to hire a bookkeeper to track personal finances.